Generate LLC Operating Agreement

A LLC Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC). It typically includes information such as the rights and responsibilities of members, how profits and losses will be allocated, and how the company will be managed.

Last Updated April 2023

Alternative names:

LLC Operating Agreement Company Agreement Operating Agreement for LLC Partnership AgreementWhat is a LLC Operating Agreement?

A LLC Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC). It establishes the rules and regulations governing the company's management, including the powers and responsibilities of its members or managers, the allocation of profits and losses, and the distribution of assets in the event of dissolution. The agreement is not required by law in most states, but it is highly recommended as it can help to prevent misunderstandings, disputes, and legal issues among members.

The LLC Operating Agreement is a crucial document that defines the structure and organization of an LLC. It can provide specific guidance on the day-to-day operations, decision-making processes, and financial management of the company. The agreement can also be tailored to the needs of the LLC and its members, allowing for greater flexibility and customization. It may include provisions for admitting or removing members, establishing voting rights, and creating classes of membership with different privileges and obligations. Additionally, the agreement can address potential scenarios that could arise in the future, such as the sale or transfer of ownership, the dissolution of the company, or the resolution of disputes. Overall, the LLC Operating Agreement serves as a comprehensive blueprint for the LLC's governance and helps to ensure its long-term success.

Who needs an LLC Operating Agreement?

Any limited liability company (LLC) that has more than one member should have an LLC Operating Agreement. Although some states do not require an operating agreement for single-member LLCs, it is still recommended to have one as it can help protect the owner's personal assets by clearly defining the separation between personal and business assets.

In general, an LLC Operating Agreement is essential for any LLC that wishes to establish a clear and organized structure for the company's management and operations. It is particularly important for multi-member LLCs, as it can help prevent disputes and misunderstandings among members by establishing clear rules for decision-making, profit-sharing, and the distribution of assets. The agreement also helps to protect the LLC's limited liability status by demonstrating that the company is operating as a separate legal entity and not simply an extension of its members' personal affairs.

What should I include in my LLC Operating Agreement?

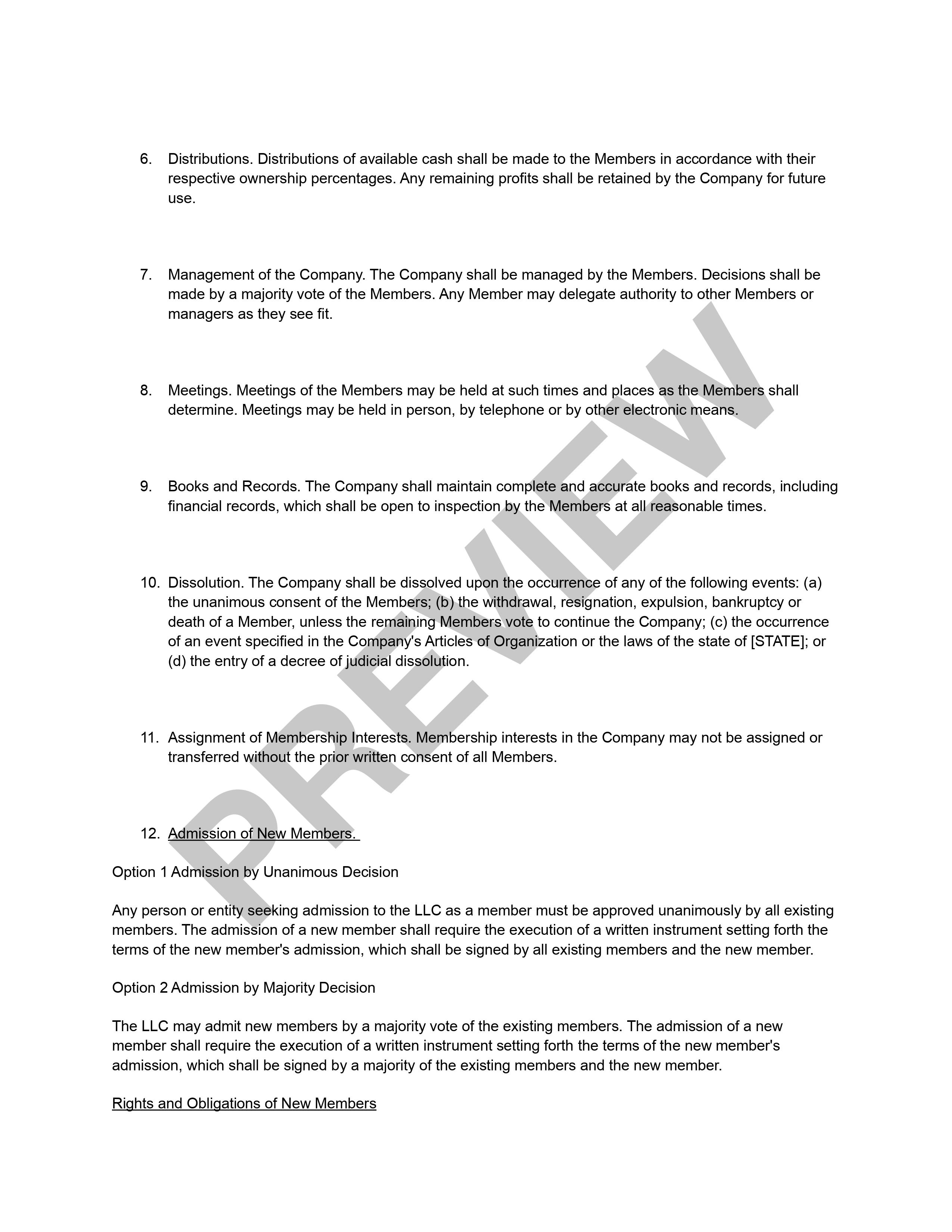

The specific content of an LLC Operating Agreement may vary depending on the needs and goals of the LLC and its members, but generally, it should include the following:

-

Company information: Name and address of the LLC, the date of formation, and the state where it was formed.

-

Member information: Names and addresses of all members, their contributions to the LLC, their ownership percentages, and their roles and responsibilities.

-

Management structure: Whether the LLC will be member-managed or manager-managed, and the powers and responsibilities of each.

-

Decision-making: How decisions will be made, including voting requirements, quorum, and procedures for amending the operating agreement.

-

Profit and loss allocation: How profits and losses will be allocated among members, including whether there will be different classes of membership with different allocations.

-

Distributions: When and how distributions will be made to members, and whether there are any restrictions on distributions.

-

Transfer of ownership: Procedures for transferring ownership interests, including restrictions on transfers and the rights of first refusal.

-

Dissolution: The process for dissolving the LLC, including how assets will be distributed among members and how outstanding debts and liabilities will be resolved.

-

Dispute resolution: Procedures for resolving disputes among members, including arbitration or mediation if necessary.

-

Miscellaneous provisions: Any other provisions that are specific to the LLC and its members, such as confidentiality agreements, non-compete clauses, or intellectual property ownership.

It is important to note that an LLC Operating Agreement is a legal document, and it should be drafted by a qualified attorney to ensure that it complies with state laws and regulations and protects the interests of all members.

Can an LLC Operating Agreement override state law?

An LLC Operating Agreement can override certain provisions of state law, as long as the agreement does not violate state laws or public policy. However, there may be some provisions in state laws that cannot be overridden by an LLC Operating Agreement. For example, an LLC Operating Agreement cannot override laws that protect the rights of employees or consumers, or laws that require certain types of licenses or permits to operate a business. It is important to consult with a qualified attorney who has experience in business law to ensure that the LLC Operating Agreement complies with state laws and regulations.

Frequently Asked Questions

In most states, an LLC Operating Agreement is not required by law. However, it is highly recommended to have one, as it can help to prevent misunderstandings, disputes, and legal issues among members. Even if an LLC is not required to have an Operating Agreement under state law, it may be required by banks, investors, or other entities with which the LLC does business. Additionally, having an LLC Operating Agreement can help demonstrate that the LLC is a legitimate and well-organized business entity, which may be helpful in the event of legal disputes or audits.

Technically, an LLC can have multiple Operating Agreements, but it is generally not recommended as it can lead to confusion and conflicts among members. The purpose of an Operating Agreement is to establish the rules and procedures that govern the operation of the LLC and to outline the rights and obligations of its members.

If there are multiple Operating Agreements, it can create inconsistencies and conflicts in the operation of the LLC, and it may not be clear which agreement governs in a given situation. It is generally recommended that an LLC have one comprehensive Operating Agreement that is carefully crafted to meet the specific needs and goals of the LLC and its members.

The state in which you should make your LLC Operating Agreement depends on the state where your LLC is registered or where it will be doing business.

The LLC Operating Agreement should comply with the laws and regulations of the state where the LLC is formed or registered. Each state has its own laws and regulations regarding LLCs, so it is important to consult with a qualified attorney who has experience in business law in the relevant state. An attorney can help you understand the legal requirements for an LLC Operating Agreement in that state and can assist in drafting an agreement that meets your specific needs and goals as an LLC.

Even though a single-member LLC is owned and operated by only one member, it is still recommended to have an LLC Operating Agreement. While some states may not require a single-member LLC to have an Operating Agreement, having one can help to establish the LLC as a separate legal entity, separate from the owner, which may provide legal protection.

An Operating Agreement can also provide guidance on how the LLC will be operated, how profits and losses will be allocated, how the LLC can be dissolved, and other important matters. Additionally, having an Operating Agreement can be helpful if the single-member LLC intends to bring in additional members in the future or if the LLC is seeking financing or entering into contracts with third parties. An attorney can help a single-member LLC draft an Operating Agreement that meets their specific needs and complies with state law.

It is generally recommended to create an LLC Operating Agreement as soon as possible after forming your LLC. An LLC Operating Agreement sets out the rules and procedures for operating the LLC and defines the rights and obligations of the LLC's members, so it is important to establish these rules and procedures as soon as possible to avoid misunderstandings or disputes among members.

In some states, an LLC Operating Agreement is not required by law, but it is still recommended to have one in place. Furthermore, if you plan on applying for financing, entering into contracts with third parties, or bringing in additional members in the future, having a comprehensive LLC Operating Agreement can demonstrate that your LLC is a legitimate and well-organized business entity.